-

Fabian Way

Palo Alto, CA • Equity Raise

Client: Confidential

Buyer/Investor: Confidential

292 Units

In Escrow

Fabian Way presents an opportunity to control a pipeline project with reduced entitlement risk and financial exposure that will be ready for construction in what is anticipated to be a more favorable financing and cost environment. Due to required environmental mitigation (the responsibility of the Landowner), the projected construction start date is late 2027. It is anticipated that, following entitlements and during the environmental remediation process, there will be ample time to prepare a fully designed construction package, obtain GMAX pricing, and engage an LP capital partner all before the option to ground lease is exercised.

-

Pacific Coast Commons

El Segundo, CA • Equity Raise

Client: Mar Ventures / Continental Development Corp.

Buyer/Investor: TBD

263 Units

On the Market

Mar Ventures and Continental Development Corporation are in contract to purchase two sites in El Segundo, CA, entitled for 257 apartments and 6 townhomes that could either be operated as rentals or be sold off to buy down the overall project costs. They are seeking a co-GP development partner who will also bring a majority of the capital to build the Project, known as Pacific Coast Commons.

-

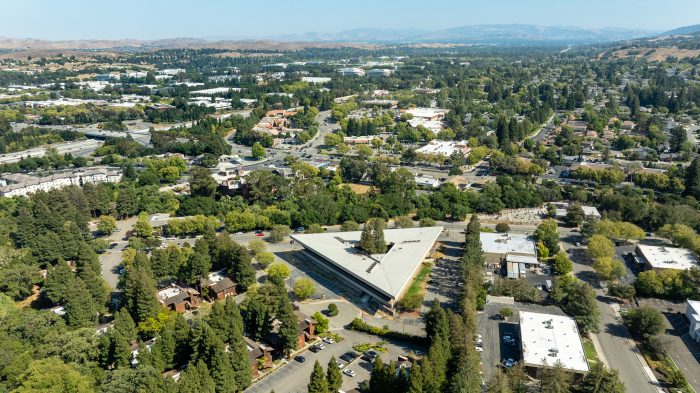

Woodside Canyon

San Ramon, CA • Land Sale

Client: City Ventures

Buyer/Investor: TBD

54 Units

On the Market

Prime San Ramon location entitled for 54 townhomes. Construction drawings are nearly finished and will be included in the sale.

-

2930 Pacific Avenue

Livermore, CA • Land Sale

Client: Swenson

Buyer/Investor: TBD

115 Units

In Escrow

2930 Pacific Avenue (the “Property”) is a best-in-class, 115-unit townhome development site poised for immediate approvals in a top Tri-Valley submarket. This ±6.5-acre infill property provides future residents walkability to Livermore's thriving downtown and its appealing array of amenities, while seamlessly integrating into the highly desirable surrounding community. Situated within one of the Bay Area’s leading economic hubs, 2930 Pacific Avenue benefits from an expedited path to final approvals, positioning the project to capitalize on robust housing fundamentals driven by a booming Tri-Valley economy and projected 30% median household income growth over the next five years.

-

5885 Carpinteria

Carpinteria, CA • Land Sale

Client: Confidential

Buyer/Investor: Confidential

190 Units

In Escrow

5885 Carpinteria is a 27.53-acre development site on a bluff overlooking the Pacific Ocean in Carpinteria, California. Carpinteria is a picturesque coastal town just south of Santa Barbara, situated between one of California’s most beautiful stretches of shoreline and the stunning Santa Ynez mountain range. Kevin Costner, George Lucas, and Ellen DeGeneres own homes in Carpinteria with values in the $25 - $145 million range.

-

1500 Rosecrans

Manhattan Beach, CA • Land Sale

Client: Continental Development Corporation

Buyer/Investor: Lincoln Property Company

550 Units

Closed

1500 Rosecrans is a generational opportunity to redevelop a prime, 4.93-acre parcel located 2-miles from the Pacific Ocean in Manhattan Beach, California. Manhattan Beach is widely regarded as one of the most prestigious residential communities and top beach towns in Southern California with a public school district ranked among the top 5% in the state, strong household incomes, a thriving economic engine, and outstanding beaches, retail, dining and nightlife options.

-

Monarch Hillside

San Diego, CA • Equity Raise

Client: Monarch Group/Klein Financial

Buyer/Investor: Confidential

249 Units

Closed

Monarch Hillside is an entitled shovel-ready workforce housing development in the Encanto neighborhood of San Diego, four miles east of downtown. This project will bring much needed housing to an undersupplied area of the city. It will be financed with tax credits and tax exempt bonds, and approximately 40% of the apartments will be set aside for households that earn less than 80% of the median income.

-

Alameda Point Blocks 10, 1a, and 15

Alameda, CA • Land Sale

Client: Alameda Point Partners

Buyer/Investor: TBD

200 Units

On the Market

This is an opportunity to build approximately 200 attached townhomes on 10 acres in a spectacular waterfront master planned community on the island city of Alameda. The project benefits from flexible approvals that allow for the construction of either a for-sale or for-rent townhomes. It is located in Alameda Point, a former Naval Air Station that has been transformed into a highly desirable neighborhood with luxury apartments, high-end townhomes, a new ferry terminal and eight acres of public parks and open space with some of the most striking waterfront views in the entire Bay Area.

-

Aya Phase III

Fremont, CA • Equity Raise

Client: Quarterra Multifamily

Buyer/Investor: Confidential

336 Units

Closed

Warm Springs Phase III is an opportunity to partner with one of the country’s premier developers, Quarterra Multifamily Living, to build a 336-unit multifamily community in the brand new Warm Springs District in Fremont, CA, which includes luxury homes, new parks, a brand new elementary school, and state-of-the-art office and R&D space, making this one of the best mixed-use neighborhoods in the entire Bay Area.

-

Los Gatos Lodge

Los Gatos, CA • Land Sale

Client: Private

Buyer/Investor: TBD

155 Units

Closed

Los Gatos Lodge is a generational opportunity to redevelop a prime, 8.81-acre site located a half-mile from Downtown Los Gatos in one of the premier suburban enclaves of Silicon Valley. The site is currently improved with a 129-key hotel, offering investors an opportunity to acquire an income-producing asset while re-entitling the property for multifamily development. Housing is allowed “By Right” with a density between 30 DU/AC and 40 DU/AC, and a range of product types that could include attached townhomes, single-family residential, senior living, hospitality, and podium, wrap or garden-style apartments. It may also be possible to increase the project’s density by utilizing the California State Density Bonus, or build to a lower density in line with the prior General Plan.

-

Los Gatos Green

Los Gatos, CA • Land Sale

Client: Peck Leasing, LTD

Buyer/Investor: City Ventures

55 Units

In Escrow

Los Gatos Green is a premier townhome-style community development located at 15349 & 15367 Los Gatos Blvd in the town of Los Gatos. The project will encompass 55 for-sale solar all-electric townhome-style homes ranging from approximately 202 to 1,594 sq ft, many homes encompassing a two-car private garage (88 spaces) accessed by a common drive aisle. The community will host 47 market rate homes, of which there will be 4 units designed as live/work along Los Gatos Blvd. There will be 8 inclusionary below market rate units. Many homes will feature dedicated front yard areas and oversized decks that support the indoor/outdoor relationship. There will be 8 floor plans, 5 residential buildings in total with 5 unique residential building types, common area green, and 10 guest parking spaces. A blending of the newly constructed townhomes with the existing environment will create a premier community in the town of Los Gatos.

-

703 Third Street

San Rafael, CA • Land Sale

Client: Seagate Properties

Buyer/Investor: Confidential

120 Units

Closed

703 Third Street is a mixed-use development site entitled for 120 apartments in downtown San Rafael, one of the top suburban-core apartment markets in California with affluent demographics, outstanding quality of life and high-median home values putting homeownership out of reach for most residents. The property is walkable to dozens of restaurants, cafes, retailers and bars in one of the most supply constrained markets in the country due to natural land constraints and lengthy approval times associated with environmental review, a vigorous appeal process and discretionary approval procedures. The site is a 30-minute drive to San Francisco with multiple transit options including car, bus, train, and ferry.

-

Deer Creek Village

Petaluma, CA • Land Sale

Client: Merlone Geier Partners

Buyer/Investor: MBK Rental Living

134 Units

Closed

Deer Creek Village is an entitled, 134-unit multifamily development site adjacent to a 257,000 SF grocery-anchored retail center in Petaluma, CA. It is the residential component within the Deer Creek Village Shopping Center, which was completed in 2017 and is anchored by a Smart & Final, City Sports Fitness and Friedman’s Home Improvement. Other retail tenants include Jamba Juice, The Habit Burger, Dunkin’ Donuts, Exchange Bank, Sourdough & Co, Mary’s Pizza Shack, Sutter Health, and DaVita Dialysis.

-

Gateway Crossings Phase I

Santa Clara, CA • Land Sale

Client: Hunter Storm

Buyer/Investor: Holland Partner Group

725 Units

Closed

Gateway Crossings is an entitled, ±23-acre mixed-use development located walking distance from the Santa Clara Caltrain Station, Santa Clara University and the future southern terminus for BART’s Silicon Valley extension.

-

Alameda Point Blocks 6 & 7

Alameda, CA • Land Sale

Client: Trammel Crow Residential

Buyer/Investor: Trumark Homes

124 Units

Closed

Alameda Point is comprised of 878 acres on the former Naval Air Station Alameda. The City of Alameda has programmed the redevelopment of the entire area to include high-end residential, retail, office, a new ferry terminal, and over 250 acres of parks and open space. Berkadia was retained to source equity for the development of Site A (68 acres), as well as sell Blocks 6 & 7 to a home builder (124 units).

-

1910 N Broadway

Walnut Creek, CA • Land Sale

Client: BayRock Multifamily

Buyer/Investor: CityView

141 Units

Closed

1910 N Broadway is an entitled, 141-unit multifamily development site located in one of the best suburban-core apartment markets in the entire Bay Area with direct pedestrian access to BART and the East Bay’s premier retail and dining destination: Downtown Walnut Creek. The project can proceed without the need for City Council approval or public comment as a “By Right” development with only Design Review Approval remaining. Design Review is heard only by the City’s Design Review Committee and would include additional units allowed under the State’s Density Bonus Law, bringing the total unit count to 141 apartments. The project is open shop construction with no union or prevailing wage requirement, and only 8% of the total units reserved for Below Market Rate apartments as a condition of the State Density Bonus.

-

The Lafayette

Santa Clara, CA • Equity Raise

Client: SummerHill Apartment Communities

Buyer/Investor: Invesco

347 Units

Closed

The Lafayette is a fully-entitled, 347-unit development site across the street from Levi’s Stadium and a VTA light rail station, and adjacent to Related Santa Clara, an $8 billion mixed-use development breaking ground this summer that has been touted as the Hudson Yards of Silicon Valley.

-

The Asher

Fremont, CA • Land Sale

Client: Guardino Family Trust

Buyer/Investor: Carmel Partners

673 Units

Closed

1031 Walnut is a 14-acre infill development opportunity in Fremont, CA, and one of the few remaining transit-oriented parcels of scale located two blocks from the Fremont BART Station.

-

Tam Ridge Residences

Corte Madera, CA • Equity Raise

Client: MacFarlane Partners

Buyer/Investor: AIG

180 Units

Closed

Tam Ridge is an equity solicitation for the development of 180 units and approximately 3,000 square feet of ground floor retail in Corte Madera, CA.

-

888 San Mateo

San Mateo, CA • Build-to-Suit

Client: SARES-REGIS Group

Buyer/Investor: PNC / AFL-CIO Building Investment Trust

160 Units

Closed

888 San Mateo is a build-to-suit transaction between SARES-REGIS Group and PNC / AFL-CIO Building Investment Trust for the development of 160 luxury apartments in San Mateo, CA. The northern Peninsula location is within walking distance of downtown Burlingame and the Burlingame CalTrain Station.

-

1505 At Central Station

Oakland, CA • Land Sale

Client: HFH, Ltd

Buyer/Investor: City Ventures

125 Units

Closed

1505 at Central Station is an entitled, 6.15-acre, transit-oriented multifamily development site in West Oakland, CA. This site was sold to City Ventures, along with BUILD West Oakland, with plans to build 185 for-sale townhomes with a projected completion date of Q1 2017.

-

BUILD West Oakland

Oakland, CA • Land Sale

Client: Bridge Housing Corporation

Buyer/Investor: City Ventures

60 Units

Closed

BUILD West Oakland is a 2.1 acre development site entitled for 60 for-sale townhomes in West Oakland, CA. This site was sold to City Ventures, along with 1505 at Central Station, with plans to build 185 for-sale townhomes with a projected completion date of Q1 2017.

-

Hercules Bayfront

Hercules, CA • Land Sale

Client: AndersonPacific

Buyer/Investor: Ledcor Properties

1,392 Units

Closed

Hercules Bayfront is a fully-entitled, master planned project consisting of 21.2 net acres and flexible entitlements that permit the construction of up to 1,392 multifamily units and 340,000 sq. ft. of commercial space. The project is one of the largest waterfront development opportunities within 30 minutes of San Francisco in the East Bay City of Hercules, with median incomes over $100,000, average occupancy of 97.9% and 6.2% annual rent growth.

-

Mosso

San Francisco, CA • Build-to-Suit

Client: TMG Partners / AGI Capital

Buyer/Investor: Essex Property Trust

463 Units

Closed

The development site was acquired and entitled by a Avant Housing, a joint venture between TMG Partners, AGI Capital and CalPERS. The project was presold by Moran & Company to Essex Property Trust, which took title to the land and hired Avant Housing to manage the construction. The nine-story, Type 1 concrete project spans two city blocks in the SoMa District of San Francisco and includes 463 units and 9,400 sf of ground floor retail.

-

One Hundred Grand

Foster City, CA • Land Sale

Client: Foster City Executive Park Partners

Buyer/Investor: Thompson Dorfman Partners / CityView

166 Units

Closed

One Hundred Grand is a 4.92-acre development site entitled for 166 apartments and 50,000 sf of office.

-

Ambrose

Oakland, CA • Equity Raise

Client: The Martin Group

Buyer/Investor: TBD

220 Units

On the Market

The Martin Group (“Sponsor”) is seeking an investor to participate in a joint venture to develop and operate a 220-unit, podium-style apartment community called Ambrose in Oakland, CA. The project is ready to issue permits and has a GMP proposal ready to be signed, significantly reducing cost risk and offering an investor the opportunity to start construction immediately after closing.

-

Civic Station

Pittsburg, CA • Land Sale

Client: DeNova Homes

Buyer/Investor: Confidential

81 Units

On the Market

Civic Station is an 81-unit multifamily development site in a prime, transit-oriented location walking distance to BART in Pittsburg, CA. The project is entitled with an approved condo plan allowing for either rental apartments or for-sale condominiums, and has been designed for the post-Covid era with a unit mix that includes 98% two-bedrooms and a direct access garage for every unit, making it ideal for telework and young families seeking a relatively affordable suburban market with access to rail transit.

-

The District

San Francisco, CA • Land Sale

Client: Thompson Dorfman Partners

Buyer/Investor: KB Home

81 Units

Closed

The District is a fully-entitled, 81-unit development site in Lower Pacific Heights. Up until very recently, it was the highest price per door land sale in the history of San Francisco. The property is adjacent to the iconic Pacific Heights neighborhood in an established, upper-class area where the opportunity to live in a new, luxury San Francisco condo is extremely rare.

-

The Parker

Berkeley, CA • Equity Raise

Client: Lennar Multifamily Communities

Buyer/Investor: RREEF

155 Units

Closed

The Parker is an off market equity soliciation for the development of 155 units and 28,000 sf of ground floor retail located at the site of a former auto dealership in downtown Berkeley developed by Lennar Multifamily Communities and RREEF.

-

The Triton

Foster City, CA • Land Sale

Client: Prologis / AMB Property Corp

Buyer/Investor: Thompson Dorfman Partners / Ares Management

240 Units

Closed

The Triton (formerly Hillsdale Tech Park) is a 6.3-acre mixed-use multifamily development site entitled for 240 apartments and 5,000 sq. ft. of ground floor retail in Foster City, CA. The development will be the third phase of the 20.75-acre Pilgrim Triton Master Plan previously approved for the development of 296,000 square feet of commercial/industrial office use, 730 residential units and a one-acre park. The project was completed in Q1 2018.

-

ViO

San Jose, CA • Land Sale

Client: MacFarlane Partners

Buyer/Investor: JDA West

234 Units

Closed

ViO (formerly Cottle Station) is a fully-entitled, 5.85-acre development site consisting of 234 apartments and 5,000 square feet of ground floor retail in San Jose, CA. It is a mixed-use project within the Village Oaks master plan of the Hitachi General Development Plan.

-

Union Flats

Union City, CA • Equity Raise

Client: Windflower Properties

Buyer/Investor: CityView

243 Units

Closed

Union Flats is 243-unit transit-oriented development opportunity located directly across the street from the Union City BART station and walking distance from a Safeway-anchored retail center. The property is located in the 145-acre Station District master planned community adjacent to 1.2 million square feet of future Class “A” office space, and is the first apartment community built in supply-constrained Union City in the last 20 years.

-

Venn on Market

San Francisco, CA • Equity Raise

Client: MacFarlane Partners

Buyer/Investor: AIG

113 Units

Closed

Venn on Market is an equity solicitation for the development of 113 apartments in San Francisco, CA. The property is located on Market Street, with easy access to Hayes Valley, The Mission, Lower Haight, the Castro and SoMa.

-

Eastvale Phase I

Eastvale, CA • Equity Raise

Client: Quarterra Multifamily

Buyer/Investor: Confidential

320 Units

Closed

Equity raise for Quarterra Multifamily Communities (“QMC”) for a 320-unit shovel-ready, garden-style, all-market-rate apartment development in the 158-acre Leal Master Plan in Eastvale, CA. Eastvale is the second youngest city in California. Its average home values are $942,663, and its median household income of $162,853 (2023 American Community Survey) is #1 in the Inland Empire, and would rank it among the highest-income cities in neighboring Orange County.

-

1111 Wilshire

Los Angeles, CA • Equity Raise

Client: Holland Partners

Buyer/Investor: UBS

204 Units

Closed

1111 Wilshire is a 204-unit joint venture equity solicitation completed for Holland Partners with UBS in the City West District of Downtown Los Angeles.

-

Areum

Monrovia, CA • Pre-Sale

Client: Lincoln Property Company

Buyer/Investor: Associated Estates

154 Units

Closed

Areum (formerly 5th & Huntington) is a 154-unit pre-sale completed on behalf of Lincoln Property Company to Associate Estates.

-

Alta South Bay

Torrance, CA • Land Sale

Client: Shea Properties

Buyer/Investor: Wood Partners / AIG

246 Units

Closed

Alta South Bay (formerly South Vermont) is a fully-entitled development site with 246 multifamily units sold on behalf of Shea Properties to Wood Partners and AIG for $11 million.

-

AMLI Marina del Rey

Marina Del Rey, CA • Land Sale

Client: Sondermann Ring Partners

Buyer/Investor: AMLI Residential

585 Units

Closed

AMLI Marina del Rey (formerly Esprit II) is a fully-entitled, 585-unit waterfront development parcel and a 241-boat slip marina sold on behalf of Sondermann Ring Partners to AMLI Residential.

-

Amplifi

Fullerton, CA • Land Sale

Client: Red Oak Investments

Buyer/Investor: Intracorp

290 Units

Amplifi (formerly 600 W Commonwealth) is a fully-entitled, 290-unit development site located in Downtown Fullerton located near the 91, 5 and 57 Freeways, the Fullerton Amtrak Station and four colleges and universities.

-

AVA Little Tokyo

Los Angeles, CA • Land Sale

Client: K. Hovnanian

Buyer/Investor: AvalonBay Communities

174 Units

Closed

AVA Little Tokyo (formerly Matsu) is a fully-entitled, mixed-use development site in Little Tokyo approved for 174 units and 20,000 sf of retail space fronting 2nd and Los Angeles St. in Downtown LA.

-

Avalon Del Rey

Los Angeles, CA • Equity Raise

Client: AvalonBay Communities

Buyer/Investor: SSR Realty Advisors

309 Units

Closed

Avalon Del Rey is a 309-unit joint venture equity solicitation completed for AvalonBay Communities with SSR Realty Advisors.

-

Baker Block

Costa Mesa, CA • Equity Raise

Client: Red Oak Investments

Buyer/Investor: CityView

240 Units

Closed

Baker Block is a 240-unit joint venture equity solicitation completed for Red Oak Investments with CityView.

-

Beach Walk

Huntington Beach, CA • Equity Raise

Client: Province Group

Buyer/Investor: UDR

173 Units

Closed

Beach Walk is a 173-unit joint venture equity solicitation completed for Province Group with UDR.

-

Boardwalk

Huntington Beach, CA • Equity Raise

Client: SARES-REGIS Group

Buyer/Investor: GID

487 Units

Closed

Boardwalk is a 487-unit joint venture equity solicitation completed for SARES-REGIS Group with GID.

-

Brand + Wilson

Glendale, CA • Equity Raise

Client: Holland Partners

Buyer/Investor: UBS

401 Units

Closed

Brand + Wilson is a 401-unit joint venture equity solicitation completed for Holland Partners with UBS.

-

Del Rey Terrace

Marina Del Rey, CA • Land Sale

Client: TriCal Construction

Buyer/Investor: State Farm

96 Units

Closed

Del Rey Terrace is a fully-entitled 96-unit condo development site sold on behalf of TriCal Construction to State Farm.

-

Glo

Los Angeles, CA • Equity Raise

Client: Holland Partners

Buyer/Investor: Berkshire Income Realty

201 Units

Closed

GLO is a 201-unit joint venture equity solicitation completed for Holland Partners with Berkshire Income Realty.

-

Hikari & Sakura Crossing

Los Angeles, CA • Land Sale

Client: Related California

Buyer/Investor: SARES-REGIS Group / UBS

240 Units

Closed

Hikari and Sakura Crossing (formerly 2nd & San Pedro) is a fully-entitled mixed-use development site with 240 multifamily units and 18,000 sq. ft. of ground floor retail space, sold on behalf of Related Companies of California to SARES-REGIS Group and UBS.

-

La Brea Gateway

Los Angeles, CA • Land Sale

Client: The Martin Group

Buyer/Investor: Holland Partners

179 Units

Closed

La Brea Gateway is a fully entitled mixed-use development site with 179 multifamily units and 33,274 sq. ft. of ground floor retail pre-leased to Sprouts Farmers Market, sold on behalf of The Martin Group to Holland Partners.

-

Neptune Marina

Marina Del Rey, CA • Land Sale

Client: Legacy Partners

Buyer/Investor: Greystar / Prudential Real Estate Investors

526 Units

Closed

Neptune Marina is a waterfront development site in Marina del Rey consisting of 526 units and a 174-boat slip marina on land leased from the County of Los Angeles.

-

Noho West

North Hollywood, CA • Land Sale

Client: Merlone Geier

Buyer/Investor: Trammel Crow Residential

642 Units

Closed

Noho West is a 7.48 acre, 642-unit development parcel sold on behalf of Merlone Geier to Trammel Crow Residential. The apartment parcel is located in a 25-acre mixed-use project that includes 322,000 sf of retail and 250,000 sf of brand new office space.

-

Olympic & Olive

Los Angeles, CA • Equity Raise

Client: Lennar Multifamily Communities

Buyer/Investor: US China Real Estate

201 Units

Closed

Olympic & Olive is a 201-unit joint venture equity solicitation completed for Lennar Multifamily Communities with US China Real Estate.

-

Playa Vista Phase II

Playa Vista, CA • Entity Sale

Client: Playa Capital Company

Buyer/Investor: Brookfield

2,203 Units

Closed

Playa Vista Phase II is comprised of five land sites that aggregate 14.5 acres, with entitlements for the development of up to 1,101 residential units. These five sites are part of a larger product allocation plan for Phase II of the community’s development, the Village at Playa Vista.

-

Prado on Lake

Pasadena, CA • Land Sale

Client: Private

Buyer/Investor: Hanover Company

103 Units

Closed

Prado on Lake is a fully-entitled 103-unit condo development site sold on behalf of a private client to Hanover Company.

-

The Carlyle At Colton Plaza

Irvine, CA • Land Sale

Client: GMAC

Buyer/Investor: New Pacific Realty

156 Units

Closed

The Carlyle At Colton Plaza is a partially built, fully-entitled 156-unit development parcel sold on behalf of GMAC to New Pacific Realty for $10.5 million.

-

The Dylan

West Hollywood, CA • Equity Raise

Client: Monarch Group

Buyer/Investor: Essex Property Trust

184 Units

Closed

The Dylan (formerly Santa Monica & La Brea) is a 184-unit joint venture equity solicitation completed for Monarch Group with Essex Property Trust.

-

The Highland

Los Angeles, CA • Equity Raise

Client: Lennar Multifamily Communities

Buyer/Investor: State Farm

76 Units

Closed

The Highland is a 76-unit joint venture equity solicitation completed for Lennar Multifamily Communities with State Farm.

-

The Huxley

West Hollywood, CA • Equity Raise

Client: Monarch Group

Buyer/Investor: Essex Property Trust

187 Units

Closed

The Huxley (formerly Fountain & La Brea) is a 187-unit joint venture equity solicitation completed for Monarch Group with Essex Property Trust.

-

The Lakes At West Covina

West Covina, CA • Equity Raise

Client: Lennar Multifamily Communities

Buyer/Investor: UBS

450 Units

Closed

The Lakes At West Covina is a 450-unit joint venture equity solicitation completed for Lennar Multifamily Communities with UBS.

-

The Village At Park Place

Irvine, CA • Land Sale

Client: LBA Realty

Buyer/Investor: Confidential

990 Units

Closed

The Village At Park Place is a 990-unit development parcel sold on behalf of LBA Realty to a confidential buyer.

-

The Village At Park Place II

Irvine, CA • Land Sale

Client: LBA Realty

Buyer/Investor: SARES-REGIS Group

520 Units

Closed

Village At Park Place II is a 520-unit development parcel sold on behalf of LBA Realty to SARES-REGIS Group.

-

The Village At Park Place III

Irvine, CA • Land Sale

Client: LBA Realty

Buyer/Investor: Confidential

266 Units

Closed

Village At Park Place III is a 266-unit development parcel sold on behalf of LBA Realty to a confidential buyer.

-

Uptown Newport Phase I

Newport Beach, CA • Equity Raise

Client: Shopoff Realty Investments

Buyer/Investor: The Picerne Group

483 Units

Closed

Uptown Newport Phase I is a 483-unit joint venture recapitalization completed for Shopoff Realty Investments with The Picerne Group.

-

The Ventana

Playa Vista, CA • Land Sale / Equity Raise

Client: Finger Companies

Buyer/Investor: Capri Capital

405 Units

Closed

Ventana was sold twice by Moran & Company (Berkadia), once as entitled land for the development of 405 units and once again as a pre-sale on behalf of the Finger Companies to Capri Capital.

-

Village At Bella Terra

Huntington Beach, CA • Pre-Sale

Client: United Dominion Realty

Buyer/Investor: DJM Capital Partners

467 Units

Closed

Village At Bella Terra is a a fully entitled mixed-use development site with 467 multifamily units, with Holland Partners as the developer, sold on behalf of DJM Capital Partners & to United Dominion Realty.

-

Village At Howard Hughes

Los Angeles, CA • Land Sale

Client: Equity Office Properties/Blackstone

Buyer/Investor: Equity Residential

980 Units

Closed

Village At Howard Hughes is a 980-unit development parcel sold on behalf of Equity Office Properties/Blackstone to Equity Residential for $79 million.

-

Warner Park

Woodland Hills, CA • Land Sale

Client: AvalonBay Communities

Buyer/Investor: Wood Partners

298 Units

Closed

Warner Park is a fully-entitled, 298-unit development parcel sold on behalf of AvalonBay Communities to Wood Partners.

-

9G

San Diego, CA • Equity Raise

Client: Cisterra Development

Buyer/Investor: Spruce Capital Group

241 Units

Closed

Moran & Company has been engaged by Cisterra Development to identify a joint venture equity partner to facilitate the development of 9G, a 241-unit, 22-story, trophy asset in Downtown San Diego. 9G presents an incredible opportunity to partner with one of San Diego’s most prolific developers to deliver an iconic, mixed-use development in the heart of one of California’s most desirable urban enclaves.

-

Rhodes Crossing

San Diego, CA • Equity Raise

Client: Holland Partner Group

Buyer/Investor: Invesco

342 Units

Closed

Moran & Company was engaged by Holland Partner Group to seek a joint venture capital partner to participate in the capitalization and development of Rhodes Crossing, a fully-entitled, 342-unit project located in the Carmel Valley/Torrey Highlands submarket of San Diego.

-

Livia at Scripps Ranch

San Diego, CA • Equity Raise

Client: Monarch Group

Buyer/Investor: Essex Property Trust

264 Units

Closed

Monarch at Scripps Ranch is a 264-unit joint venture equity solicitation completed for Monarch Group with Essex Property Trust.

-

No properties were found.